Private Foundations & Donor Advised Funds

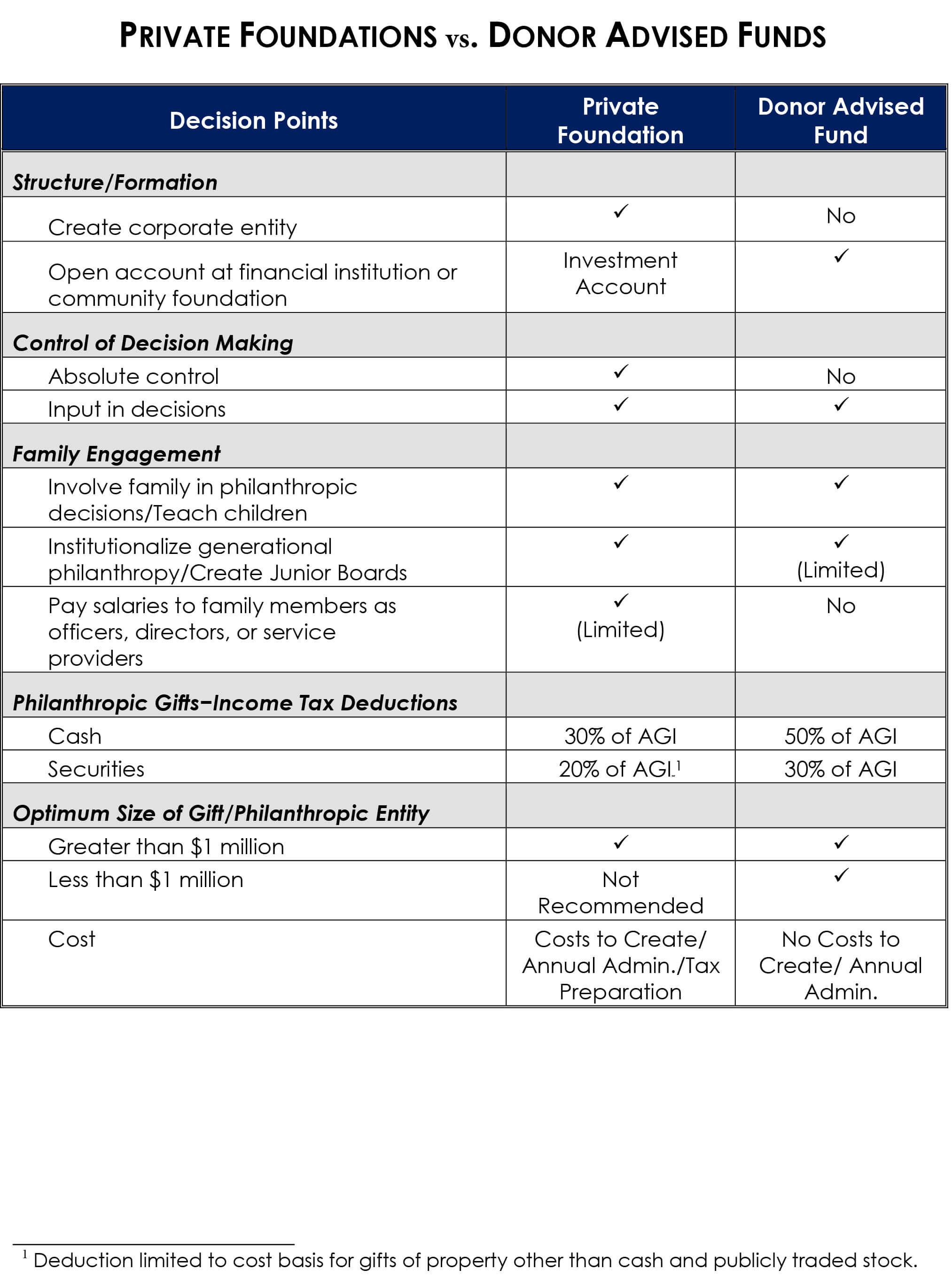

A Donor Advised Fund (“DAF”) is a charitable-giving account administered by a sponsoring organization, such as a community foundation or a financial services company. It is designed as an accessible, simple, and less expensive alternative to a Private Foundation (“PF”). Although DAFs are more imited than PFs, both PFs and DAFs are excellent vehicles for philanthropic giving. In determining the best alternative for your client, consider the following differences between DAFs and PFs.

Structure

Much like a PF, with a DAF, a donor irrevocably contributes assets to an account created by the sponsoring organization – either a community foundation or a financial services firm – in exchange for a current income tax deduction. There is no real set-up work or maintenance required as the sponsoring organization handles record keeping and due diligence on grant recipients.

The PF on the other hand, typically requires the formation of a corporate entity, the formation of a board of directors and corporate officers, record keeping, and other administrative functions. Although the PF requires more involvement, it provides clients with greater control and flexibility.

Control

Maybe most importantly, the DAF is UnotU legally bound to follow the donor’s investment or distribution recommendations. Although most DAFs allow their donors wide latitude in directing funds to legitimate charitable organizations, there are limitations and sometimes prohibitions (e.g., donors cannot enter into pledge agreements and distributions from the fund cannot be made to private non-operating foundations or, generally, to foreign charitable organizations). Most DAFs will only make grants to public charities. In contrast, donors may retain complete authority over investment and distribution decisions when using the PF model.

Legacy

Although some DAFs allow limited succession planning, eventually the remaining assets are contributed into a general fund at the sponsoring organization.

PFs foster long-term family involvement and maintain a family’s control over their charitable funds. Families create a PF and use the corporate structure to engage the next generation in their philanthropic mission and encourage stewardship. Family members may serve on the PF’s board of directors and control investment and distribution decisions. Junior family members may serve on a junior board or as members of committees where they can be trained in issues including investing, budgeting and corporate governance.

Costs

The annual fee paid to a DAF is typically less than the annual costs of administering a PF.

The DAF is less expensive and therefore often a better solution for clients planning to contribute less than $1 million. The administrative fee charged by the DAF is usually based on the amount of assets contributed to the donor’s DAF account.

For clients planning to make a more sizeable contribution and hoping to create a lasting family legacy, the PF may be a better alternative. The PF created as a corporate entity will have more administrative requirements than the DAF. As a result, a PF typically needs at least $1 million of funding to be cost-effective. Ideally, the PF must earn enough cash on its investments to cover its administrative costs.

Privacy

Both DAFs and PFs file annual publicly available tax forms (Form 990 and Form 990-PF). Many documents about specific PFs are readily available on the Internet and anyone can search certain criteria such as where a non-profit group contributed money. However, if certain steps are taken anonymity is possible. A simple way for creators of PFs to ensure privacy is to avoid including the family name in the name of the PF and have all inquiries directed to an attorney or other trusted adviser.

Giving through a DAF creates a greater degree of anonymity for donors. Although it is still possible to see the amount of assets contributed into a DAF, information regarding the ultimate distribution of the assets is not publically available.

Tax Deduction

Gifts to both PFs and DAFs are tax deductible subject to Adjusted Gross Income (“AGI”) limitations. In exchange for the lack of control and opportunities for engaging family members in a philanthropic mission, DAFs provide maximum tax deductibility to donors.

When discussing a charitable contribution with clients, focus on their long term goals. Clients interested in creating a family legacy and earmarking a larger portion of their estate for charitable endeavors are usually better served by the PF, while clients considering a one-time contribution and aren’t interested in having junior family members participate in grant making activities are well suited for the DAF. Review administrative costs and deduction limitations in light of their long term philanthropic plans.

| DAF | PF | |

|---|---|---|

| Cash | 50% of AGI | 30% of AGI |

| Securities | 30% of AGI | 20% of AGI |