Business Succession Presentation

Business Planning – Managing Value through Life Insurance

Overview

Business Planning – Case Studies

- Life Insurance Funded Buy-Out

- Family Equalization with Life Insurance

Planning the Business Succession

- Advisor Team

- Information Needed

- Product Guidance

Maintaining the Plan

Take-Aways

- Business Planning Information/Intake Checklist

- Sample Client Audit/Review Letter

Insurance Funded Buy-Out

Facts

- $100 million S corporation (“S Co.”)

- Owned equally by 3 founders: X, Y and Z

- No current plans to sell S Co.

Objectives

- Facilitate shareholder buy-out at death/disability

- Money/liquidity is always an issue

- Avoid conflicts in buy-out funding

- Upfront cash vs. deferred, longer term-payments from notes

- Implement valuation plan to value shares

- Discounts for minority interests, premiums for control?

- Provide funding for premium payments

- Parity among shareholders whose ages/health may vary

- Minimize estate tax impact of life insurance proceeds on value of business and shareholders’ estates

- Corporate owned – estate inclusion at corporate value level

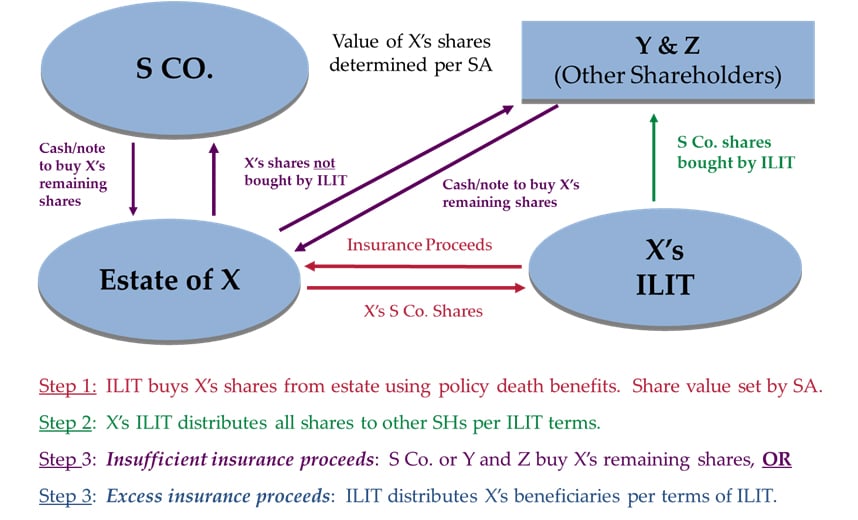

The Plan

- Separate ILITs

- X, Y, & Z each execute irrevocable life insurance trusts (ILITs)

– Other shareholders must review/approve ILIT form - ILIT terms require trustee to:

– Use life insurance proceeds (up to policy’s face) to buy deceased shareholder’s shares

-Distribute purchased shares to remaining shareholders

-Distribute remaining proceeds to designated ILIT beneficiaries

- X, Y, & Z each execute irrevocable life insurance trusts (ILITs)

- Life Insurance

- Each ILIT buys a $33 million policy on its shareholder

- Shareholder’s Agreement (SA)

- Allows sale of deceased shareholder’s shares to his ILIT

- Allows distribution of shares from ILIT to remaining shareholders

- Requires S Co. or other shareholders to buy any remaining shares of deceased shareholder

– Takes effect only after ILIT uses all proceeds to buy shares

– S. Co./shareholder may fund their purchases with cash, guaranteed promissory notes, based on SA

- Valuation Set by SA

- Critical to set value for shares

– Determines liquidity/funding needs - SA provides that fair market value:

– Is determined by independent expert chosen from agreed-to list of appraisers

– Does not reflect minority discounts / control premiums

- Critical to set value for shares

The Plan – Why?

- Estate Tax Benefits

- Keeps policy proceeds/cash values out of S Co. and owners’ estates

- Fixes estate tax value of shares

- Solves shareholders’ estate liquidity concerns

- Income Tax Benefits

- Shares purchased by ILIT and distributed to other shareholders receive new tax basis equal to purchase price

- Basis increase = capital gains tax savings at later sale of shares

- Conflict Avoidance

- “Automatic” buy-out implementation – policy proceeds pass to ILIT, not other shareholders, so no need to wait on individual actions

- Pre-set valuation method for shares avoids value disagreements

Funding

- Establish 162 bonus plan for each shareholder

- Funds insurance purchase

- Credit for compensation paid

Disability Plan

- Insurance: Each shareholder buys personal disability insurance

- Serves financial planning purposes

- Redemption: S Co. redeems 20% of shareholder’s shares upon disability

- Converts balance to non-voting shares with limited veto powers

Family Equalization with Insurance

Facts

- Father is owner of S corporation

- Has four children

- Three actively employed by business

- One daughter is not (passive)

- Father will not allow a current change of control or reduction in his profit allocation

- Limited lifetime estate/succession planning options

- Wants to treat all children equally

Objectives

- Liquidity

- Estate tax exposure based on father’s retention of business

- Buy-out funding for passive daughter

- Buy-out Planning for Next Generation

- Children/owners work out decision-making process while dad is alive

- Obtain life insurance funding for anticipated business succession while they are young and healthy

- Flexibility in Exit Strategy

- Father may consider sale of business to third party

- Buy-out/funding arrangement must adapt to change in exit plan

Proposal

- Use term product to fund buy-sell if father proposes to sell business in short-term

- Consider mix with a permanent product if plan is to have a legacy based component

- While going through underwriting/examinations, look at survivorship coverage for estate plan and disability insurance

- Ensure all term coverage is convertible to preserve insurability and provide flexibility if exit strategy changes

- Insurance to buy-out daughter/father should be guaranteed to avoid later conflict/litigation

Form Advisory Team

Get Advisors in Place Early

- Successful plan requires multi-prong, coordinated approach

- Producer – insurance planning/coverage needs

- Attorney – structure implementation/documentation

- Accountant – tax treatment and reporting

- Other – financial advisors, appraisers, etc. depending on goals

Get Information

Business Structure & Ownership

- Entity – Type, Location, Organizational Documents

- C corp., S corp., partnership/LLC – can affect tax issues

- Domicile – state tax impact

- Governing documents – By-laws, partnership/operating agreements

- Owners – Number and Percentage Ownership (e.g., cap table)

- Multiple, equal owners – more coverage and cooperation to create succession structure

- Single, majority owner – more flexibility, but consider minority rights, need for equalizing distributions, etc.

- Business – Type

- Service or product oriented

- Key employees

- Corporate, regulatory and/or security requirements – government contractor? Franchise holder?

Goals

- Business Financial

- Maximum income now, reinvest for growth, or make attractive for sale?

- Anticipated Successors

- Transfer to other owners

- Transfer to family members or key employees

- Sale to third party

- Personal

- Financial – retirement, what family needs/wants now

- Estate – what and how much to provide to family later

- Timeframe

- Expected time for exit – during life or at death in months, years?

Existing Arrangements

- Current Coverage in Place

- Policy information

– Type, face amount, cash value, premiums, loans

– Insured, owner, beneficiary

– Intended purpose: buy-out funding, keyman, split-dollar, etc. - Policy performance review/audit

- Policy information

- Related agreements/arrangements

- Existing shareholders, buy-sell and/or trust agreements

- Split dollar, 409A, etc. and prior tax reporting under arrangements

- Employer-Owned Life Insurance (EOLI – IRC §101(j))

- Notice and consent documents – critical, as limited options to correct if proper notice and consent not provided and obtained

- Prior reporting of EOLI policies by business

Suggested Product Options for Business

- Convertible level term for younger owner/key person

- Permanent, survivorship coverage for family (allocate more here for investment component)

- Growing face value for appreciating businesses

- Return of premium riders to address split-dollar issues

Guidance on Existing Coverage

- 1035 exchange

- Surrender

- Keep

- Reduce face amount

Maintaining the Succession Plan

Provide On-Going Support

Post-closing support is critical to succession planning:

- Plan and coverage must adapt to changes in:

- Business value and ownership (owner departure/entry)

- Owner’s age and health status/condition (e.g., quit smoking, illness)

- Tax laws

- Need continual monitoring to maintain and meet objectives:

- Monitoring cost of insurance for split-dollar plans

- Tracking term conversion rights

- Reviewing and providing updates on policy performance (e.g., is cash value product performing to meet deferred comp objectives?)

- Provide reminders of reporting requirements to attorneys/CPAs

- Apprise of carrier changes (crediting rates, pricing, risk classifications)

- Coordinate with other advisors to remain updated on technical and business developments

- Consider a “tickle” system for annual review of plans/products