Private Placement Life and Annuity

Private Placement Life Insurance & Annuities

Private placement life insurance and annuities can provide income tax efficiency,as well as investment flexibility, asset protection and financial privacy.Chiefly, they allow the insured to have for more influence over the investment portfolio held within the contract. They are often used in conjunction with tax inefficient investments, like hedge funds, to curtail the tax liability.

What are private placement insurance products?

Private placement variable annuities (“PPVA”) and private placement variable life insurance (“PPVUL”) are similar to traditional retail deferred variable annuity contracts and variable universal life insurance contracts, where the contract owner’s premium payments are held in a separate account that is segregated from other assets of the insurer. The contract owner determines how to invest the separate account assets by choosing among various investment funds (referred to as “insurance dedicated funds” or “IDFs”) offered by the insurance company. The value of the contract owner’s separate account varies with the investment performance of the selected funds.

Why use private placement insurance products?

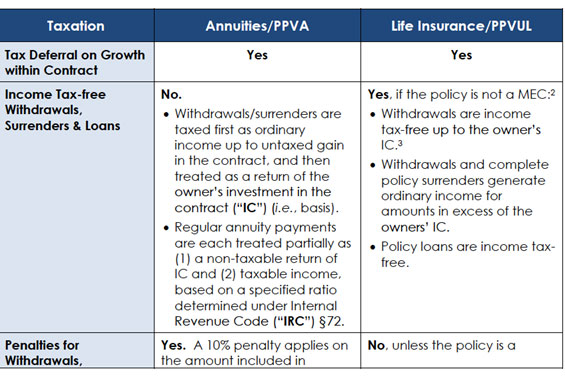

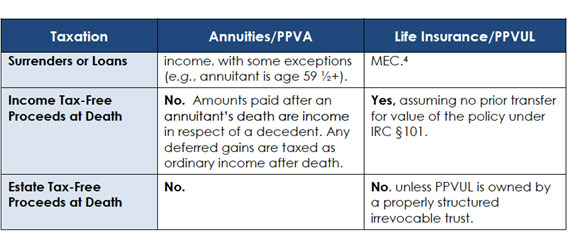

Income Tax Planning. Income tax considerations primarily drive planning with PPVA and PPVUL, since these contracts are treated as, and taxed under,the favorable income tax rules applicable to retail annuity and life insurance products.1 These rules generally can be summarized as follows:

Based on the above, PPVAs and PPVUL can provide long-term, income tax-deferred investment growth. This deferral allows the separate account investments to compound more quickly, typically generating better overall returns than under a taxable account.

PPVAs and PPVUL also can simplify the income tax reporting burdens associated with the direct ownership of alternative investments, such as limited partnerships, hedge funds, private equity funds, etc., which can require an investor to obtain and submit numerous K-1s for tax reporting purposes.Product and Investment Flexibility. When compared to retail product offerings, PPVAs and PPVUL are extremely customizable products, offering significant flexibility in both product design and implementation. A contract holder can negotiate with the insurer regarding product costs, premium due dates and amounts, death benefit payment options, etc.

In addition, contract holders will have access to a broad array of investment options through the insurer’s separate account platform, including IDFs mirroring retail mutual and index funds or invested in alternative asset classes (e.g., hedge funds, funds of funds, derivatives, etc.). A client’s investment advisor also can work to set up an IDF and become an investment manager on a carrier’s PPVA/PPVUL platform, subject to carrier due diligence and approval.Privacy and Creditor Protection. The separate account feature of PPVAs and PPVUL provides financial privacy and can protect the account assets from future creditor claims.

What issues should clients consider with private placement insurance products?

Investments Requirements. PPVA and PPVUL are complex financial products that must comply with detailed securities and investment restrictions.Key investment requirements include:

Accredited Investor/Qualified Purchaser Status. Owners of PPVAs and PPVUL must qualify as accredited investors or qualified purchasers under SEC regulations.

Account Segregation. The insurer must keep separate account assets segregated from its general accounts. This segregation prevents the carrier’s creditors from attaching separate account assets.

Investment Restrictions. IDFs must comply with the following restrictions to preserve the income tax-deferred growth of the separate account assets, or they will subject the contract holder to current taxation on the income or gain earned in the separate account:

IDFs investments can only be accessible through the purchase of an annuity or life insurance contract and cannot be made available to the public outside the product.

To comply with the “investor control doctrine” (which limits a contract holder’s control over an IDF), the contract holder cannot

(1) select any of the underlying investments of an IDF,

(2) design or change an IDF’s specific investment strategy, or

(3) have any direct or indirect arrangement with the carrier or IDF manager to set specific investments or objectives.

The separate account investments must be adequately diversified pursuant to IRC ¨817(h).

Costs and Fees. Common costs and fees associated with PPVA and PPVUL include the following. Unlike most retain products, clients will have the opportunity to negotiate certain of these expenses.

PPVUL Costs/Fees.

Commissions: Agent commissions generally range from 1% to 4% of the contract’s premiums, with a trail commission of 0.15% to 0.50% of the policy’s assets under management.

Investment Management: These fees are paid by the IDFs and usually reflect market rates. An IDF reports its investment returns net of these management fees, which avoids IRS deduction limitations often imposed on similar fees associated with taxable accounts.

M&E Charges: Trail commissions are typically paid from the mortality and expense charges levied by the carrier.

DAC Tax: The federal government imposes a Deferred Acquisition Costs Tax or “DAC Tax” on carriers, which they pass on to the PPVUL policy owner. The DAC Tax averages between 1% to 1.5% of the premiums paid.

State Premium Tax: For U.S. PPVUL products, the state of policy issuance may charge a premium tax, which can vary,depending on the state, from 1% to 3.5% of premiums paid.

Cost of Insurance: This cost changes year to year based on the net amount at risk (the difference between the death benefit and policy’s cash value), and the age, gender, and health status of the insured at underwriting.

PPVA contract costs are similar to PPVUL, but they generally do not incur charges for DAC Taxes, state premium taxes, or cost of insurance. The trade-off, however, is less favorable income tax treatment on distributions during lifetime or at death.

Choice of Carrier and Jurisdiction. Carrier selection is critical to obtaining a quality private placement product. Thus, adequate due diligence must be performed on the proposed carrier to ensure that it will be able to fulfill its contractual obligations in the future. Generally, clients will only want to purchase products from financially solvent carriers with superior credit ratings.

In addition, structuring a PPVUL acquisition requires a multi-jurisdictional evaluation, as there are numerous U.S. and offshore carriers who can issue a compliant product. The selection will depend on the client’s needs and preferences regarding on-shore/offshore carriers.

For onshore products:

Jurisdictional considerations will vary by state, depending on applicable state regulations, creditor protections, and premium tax requirements. For offshore jurisdictions, considerations will include reporting issues under the Report of Foreign Bank or Financial Account (“FBAR”) and/or Foreign Account Tax Compliance Act (“FACTA”) requirements.

Which product to choose – PPVA Or PPVUL?

The choice between private placement products will depend on the client’s circumstances and goals. Key issues for consideration include:

| Issue | PPVA | PPVUL |

|---|---|---|

| Income tax-free withdrawals and death benefits | No | Yes (non-MEC) |

| Need for client insurability and medical/financial underwriting | No | Yes |

| Limited acquisition costs and relatively simple implementation | Yes | No |

| Potentially subject to taxable “force-outs” of product cash value in excess of death benefit | No | Yes |

Overall, clients will find it simpler to acquire and implement a PPVA contract, although it will be less tax-efficient than a PPVUL contract in the long term, due to the “double” income and estate tax hit at the owner’s death.These tax considerations, however, make PPVAs optimal charitable planning vehicles for philanthropically minded clients, since naming a charitable beneficiary of the PPVA, such as the client’s private foundation, can eliminate many of the tax liabilities. PPVAs also allow clients to earmark specific assets for charities during life without relinquishing ownership or the ability to change the charitable designation (unlike with a direct, outright charitable gift).

What clients are “right” for private placement products?

Financially sophisticated clients with substantial exposure to tax-inefficient investments (such as hedge funds, commodity funds, or high-yield taxable bonds) may benefit significantly from the acquisition of PPVA and PPVUL products, since these clients often see investment returns taxed at the highest income tax rates without receiving offsetting distributions. These clients also will be attracted to the simplified tax reporting requirements associated with private placement products.

Depending on the product, the client should have at least $1 million to invest in the separate account, with an investment timeframe of 10 to 15 years for PPVUL (to overcome initial fees and expenses) or until age 59.5 for PPVAs (to avoid the 10% excise tax penalty on early withdrawals).

Generally, PPVUL will benefit clients who are insurable, need substantial life insurance coverage, and want to fund their retirement or multi-generational planning (i.e., dynasty trust) on a tax-efficient basis. PPVAs however, will best suit clients who want a quick and simple acquisition and implementation process,desire full ownership and access to their investment assets during their lifetimes,and have long-term philanthropic goals.